Weekend Reading: Projected Inflation and Investment Returns Edition

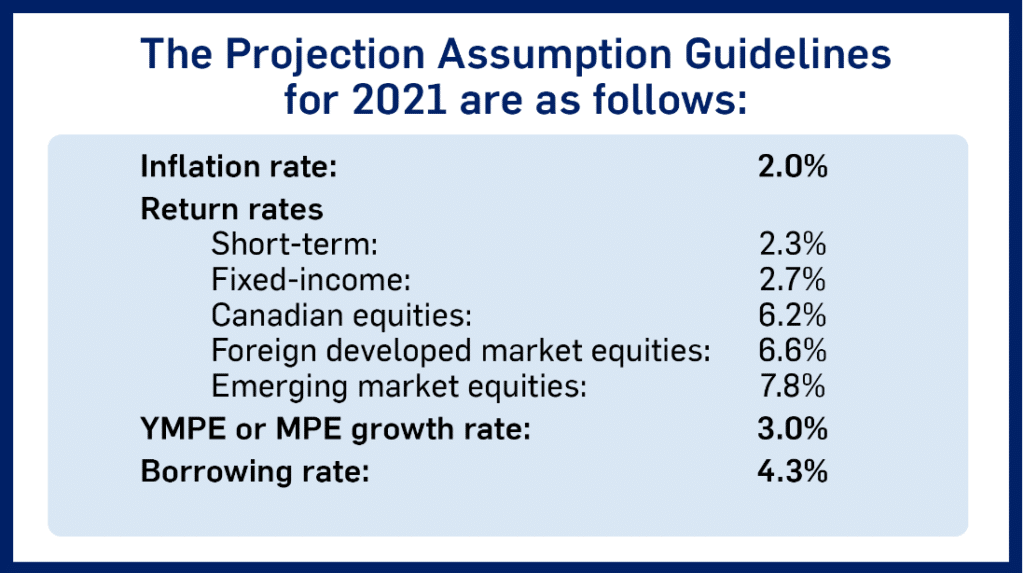

FP Canada issues guidelines every year to help financial planners make long-term financial projections for their clients that are objective and unbiased. The guidelines include assumptions to use for projected inflation and investment returns, wage growth, and borrowing rates. It also includes “probability of survival” tables that show the life expectancy at various ages.

The 2021 Projection Assumption Guidelines were of particular interest because, well, a lot has happened since the 2020 guidelines were published last spring. How should we project inflation and investment returns as we get to the other side of the pandemic and economies start opening up again?

Will we see sustained higher inflation? Should we expect any returns at all from bonds or cash? Should we lower our expectations for future stock market returns?

Remember, these are long-term projections (10+ years). That’s very different than guessing the direction of the stock market for 2021, or predicting whether we’ll see a short burst of inflation in late 2021, early 2022.

The inflation assumption of 2.0% was made by combining the assumptions from the following sources (each weighted at 25%):

- the average of the inflation assumptions for 30 years (2019 to 2048) used in the most recent QPP actuarial report

- the average of the inflation assumptions for 30 years (2019 to 2048) used in the most recent CPP actuarial report

- results of the 2020 FP Canada/IQPF survey. The reduced average was used where the highest and lowest value were removed

- current Bank of Canada target inflation rate

The result of this calculation is rounded to the nearest 0.10%

Projections for equity returns were set by combining assumptions from the following sources:

- the average of the assumptions for 30 years (2019 to 2048) used in the most recent QPP actuarial report

- the average of the assumptions for 30 years (2019 to 2048) used in the most recent CPP actuarial report

- results of the 2020 FP Canada/IQPF survey. The reduced average was used where the highest and lowest value were removed

- historic returns over the 50 years ending the previous December 31st (adjusted for inflation).

Equity return assumptions do not include fees.

Projections for short-term investment

Projections for short-term investments and Canadian fixed-income returns included the assumptions from QPP and CPP, the results of the 2020 FP Canada/IQPF survey, but the 50-year historical average rate was removed in 2020 as a data source. This makes sense given that interest rates were significantly higher than they are now and so it would be impossible for bonds to replicate the performance of the last 50 years.

How do you apply these investment return

How do you apply these investment return assumptions to your own portfolio? Let’s assume you have a balanced portfolio made up of 60% stocks and 40% bonds. Your stocks are divided up between Canadian, U.S., International, and Emerging markets. We could use Vanguard’s VBAL as a proxy:

- Canadian equities: 18% weight x 6.2% return = 1.12%

- Foreign developed market equities (includes U.S.): 37% weight x 6.6% return = 2.44%

- Emerging markets: 5% weight x 7.8% return = 0.39%

- Fixed income: 40% weight x 2.7% return = 1.08%

Total expected return from this balanced portfolio = 5.03% per year.

Subtract the MER of 0.25% and you’re left with a net expected return of 4.78% per year.

What’s interesting is how the projection assumption guidelines change over time. In 2010, the expected return for fixed income investments was 5%. In 2016 it was 4%. This year it’s 2.7%.

Projected stock returns have been trending down. Though the 2021 guidelines show modest increases for Canadian, foreign developed markets. A fairly significant increase to emerging market returns. This could simply reflect the reality that emerging markets have badly lagged the. U.S. market for the past 10 years (though the same can be said for Canadian equities).

These guidelines are a helpful reminder. When it comes to our financial plan we should take a long term view of projected inflation and investment returns. The sensible approach to high stock prices is to lower your expectation of future returns, not to panic and sell while you wait for a crash that may never come. Oh, and make sure you rebalance.

Recommended Posts

Weekend Reading: Embracing Simplicity Edition

July 12, 2021

Weekend Reading: Best Offers Yet Edition

July 1, 2021

Weekend Reading: Unhealthy Housing Market Edition

June 18, 2021

[…] account just to waive monthly fees. In that case, I think you can make one last-ditch effort to negotiate your monthly fee down to an acceptable level (as I’ve done) before you need to seriously […]