Budget 2021 Support for Small Business

Backgrounder

In the face of the COVID-19 pandemic, the government acted swiftly to provide support to protect Canadians and support people and businesses, adapting its response as the pandemic evolved. The government’s broad suite of support measures has helped families, protected jobs, and supported businesses across Canada. More than eight of every ten dollars spent to fight COVID-19 and support Canadians continues to come from the federal government.

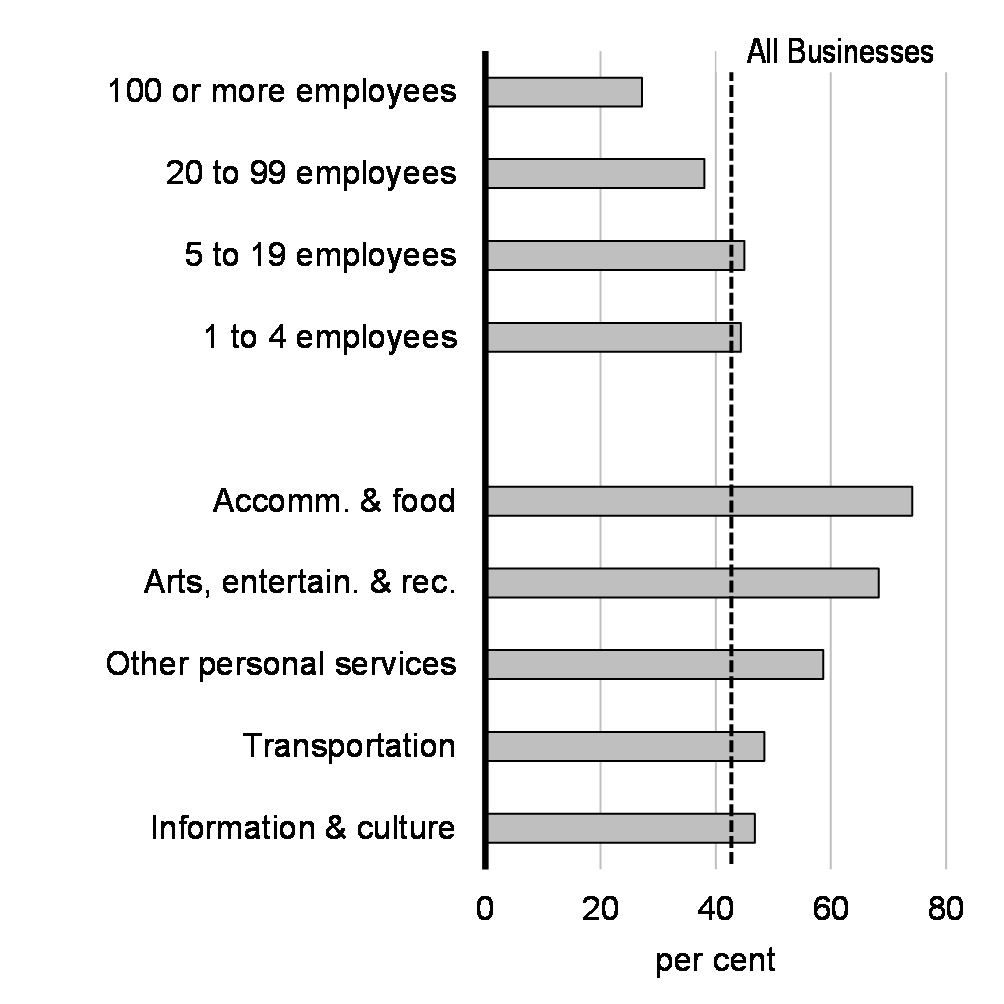

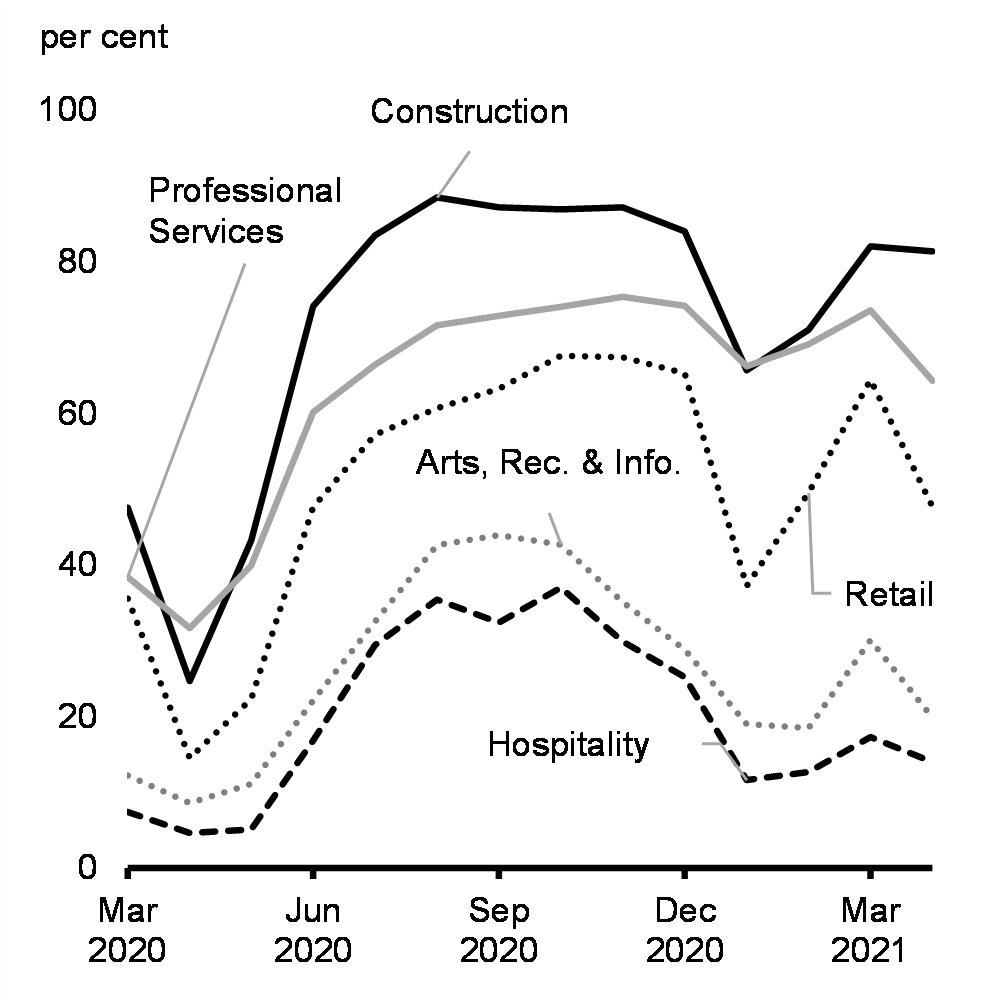

This has, in many ways, been a two-speed recession. There have been businesses that have managed to adapt to the pandemic and to prosper. But others have been shut down outright by necessary public health restrictions or deeply limited in what they can do—and many of these highly affected businesses have been our small businesses. We need them to get back on their feet. They are the backbone of our economy, our main streets, and our communities.

Budget 2021 is a plan to make targeted investments in Canada’s businesses so they can hire and train Canada’s workers, who will then have more money to spend, spurring our recovery and growing an economy with more opportunities for everyone. It is a plan to help our businesses, especially small businesses, adopt new technologies. Restoring permanent and long-term economic growth means that we must help our businesses to come back stronger than ever before.

Extension of Canada Emergency Wage Subsidy and the Canada Emergency Rent Subsidy and Lockdown Support Beyond June 2021

The Canada Emergency Wage Subsidy has helped more than 5.3 million Canadians keep their jobs, and the Canada Emergency Rent Subsidy and Lockdown Support have helped more than 154,000 organizations with rent, mortgage, and other expenses. The wage subsidy, the rent subsidy, and Lockdown Support programs are currently set to expire in June 2021. In order to bridge Canadians through the rest of this crisis to recovery, continued support is needed. To give workers and employers certainty and stability over the coming months:

-

Budget 2021 proposes to extend the wage subsidy, the rent subsidy, and Lockdown Support until September 25, 2021. It also proposes to gradually decrease the rates for the wage subsidy and rent subsidy, beginning July 4, 2021, in order to ensure an orderly phase-out of the programs as vaccinations are completed and the economy reopens.

Extending this support will mean that millions of jobs will continue to be protected.

Further details on these measures can be found in Annex 6 of the budget.

Extending the Canada Emergency Business Account

The Canada Emergency Business Account (CEBA) has provided interest-free, partially forgivable loans to more than 850,000 Canadian small businesses. In December 2020, the government increased the value of the loan from $40,000 to $60,000 to help small businesses bridge to recovery. If a business repays its loans by December 31, 2022, up to a third of the value of its loans (meaning up to $20,000) will be forgiven. In further recognition of the ongoing pandemic, the government recently extended the application deadline for CEBA to June 30, 2021.

A small number of businesses have faced challenges accessing the program, including Indigenous and rural businesses. To make sure these businesses are not left behind, the government provides similar support through the Regional Relief and Recovery Fund and Indigenous Business Initiative. To make sure these businesses can continue to access support:

-

Budget 2021 proposes to extend the application deadline for similar support under the Regional Relief and Recovery Fund and the Indigenous Business Initiative until June 30, 2021.

-

Budget 2021 proposes to provide up to $80 million in 2021-22, on a cash basis, for the Community Futures Network of Canada and regional development agencies, and to shift remaining funds under the Indigenous Business Initiative into 2021-22, to support an extended application deadline for the Regional Relief and Recovery Fund and Indigenous Business Initiative until June 30, 2021. This would support small businesses in rural communities so they can continue to serve local populations.

Helping Hard-hit Businesses Hire More Workers

For businesses that have been hit hardest by the pandemic, hiring the workers they need to grow is a cost they may worry about taking on. The government wants these businesses to be able to recover and grow by hiring more people so that workers are at the forefront of our recovery:

-

Budget 2021 proposes to introduce the new Canada Recovery Hiring Program for eligible employers that continue to experience qualifying declines in revenues relative to before the pandemic. The proposed subsidy would offset a portion of the extra costs employers take on as they reopen, either by increasing wages or hours worked or hiring more staff. This support would only be available for active employees and will be available from June 6 to November 20, 2021. Eligible employers would claim the higher of the Canada Emergency Wage Subsidy or the new proposed subsidy. The aim is to make it as easy as possible for businesses to hire new workers as the economy reopens.

As the rates for both the wage subsidy and the hiring program will slowly ramp down over time, employers will have a strong incentive to begin hiring as soon as possible and maximize their benefit.

Helping Small and Medium-sized Businesses Move into the Digital Age

The pandemic has hastened the economy’s digital transformation as companies, workers, and consumers conduct more and more business online. Canadian businesses need to adopt new technologies and digitize them to meet customer needs and stay competitive.

To fuel the recovery, jobs, and growth, the government is launching the Canada Digital Adoption Program, which will create thousands of jobs for young Canadians and help as many as 160,000 small- and medium-sized businesses adopt new digital technologies.

This program will provide businesses with two streams of support. Eligible businesses will receive micro-grants to help offset the costs of going digital—and provide support to digital trainers from a network of up to 28,000 well-trained young Canadians.

-

Budget 2021 proposes to provide $1.4 billion over four years, starting in 2021-22, to:

- Work with organizations across Canada to provide access to skills, training, and advisory services for all businesses accessing this program.

- Provide micro-grants to smaller, main street businesses to support costs associated with technology adoption.

- Create training and work opportunities for as many as 28,000 young people to help small- and medium-sized businesses across Canada adopt new technology.

-

Budget 2021 proposes to provide $2.6 billion over four years, on a cash basis, starting in 2021-22, to the Business Development Bank of Canada to help small- and medium-sized businesses finance technology adoption.

Supporting Business Investments

For Canada’s economic recovery to take root, businesses will need to invest in new technologies and move forward with capital projects. Building on the significant tax incentives introduced in the 2018 Fall Economic Statement, additional support is needed to further boost business investments that will create jobs today and in the future.

-

Budget 2021 proposes to allow immediate expensing of up to $1.5 million of eligible investments by Canadian-controlled private corporations made on or after Budget Day, and before 2024. Eligible investments will cover over 60 percent of capital investments typically made by Canadian-controlled private corporations.

This incentive targets short- and medium-term capital investments that can accelerate our recovery. This includes investments in a broad range of assets, including, but not limited to, digital assets and intellectual property, helping to further incentivize businesses to transition to a more productive, knowledge-intensive economy and will include digital assets and intellectual property. These larger deductions will help businesses—particularly small- and medium-sized businesses—by making it more attractive to invest in assets that drive growth. Larger deductions will also free up capital that businesses can use to create more good middle-class jobs.

Enhancing the Canada Small Business Financing Program

Small businesses need access to financing in order to invest in people and innovation and to have the space to operate and grow. To make sure small business and independent entrepreneurs can access the capital they need to recover, innovate, and grow in the long-term:

-

Budget 2021 proposes to improve the Canada Small Business Financing Program through amendments to the Canada Small Business Financing Act and its regulations. These proposed amendments are projected to increase annual financing by $560 million, supporting approximately 2,900 additional small businesses. Proposed amendments include:

- Expanding loan class eligibility to include lending against intellectual property and start-up assets and expenses.

- Increasing the maximum loan amount from $350,000 to $500,000 and extending the loan coverage period from 10 to 15 years for equipment and leasehold improvements.

- Expanding borrower eligibility to include non-profit and charitable social enterprises.

- Introducing a new line of credit product to help with liquidity and cover short-term working capital needs.

Lowering the Cost of Doing Business by Reducing Credit Card Transaction Fees

The pandemic has brought about a rapid and significant increase in electronic payments and online transactions. Small- and medium-sized businesses, which have been hard hit by COVID-19. Incur fees for these transactions, also known as interchange fees, which are amongst the highest in the world.

The government will engage with key stakeholders to work towards three objectives:

- Lower the average overall cost of interchange fees for merchants.

- Ensure that small businesses benefit from pricing that is similar to large businesses.

- Protect existing rewards points of consumers.

Following consultations with stakeholders, detailed next steps will be outlined as part of the 2021 Fall Economic Statement. Including legislative amendments to the Payment Card Networks Act that would provide authority to regulate interchange fees, if necessary.

Removing Barriers to Internal Trade

For too long, trade barriers within our own country have held back Canadian businesses from reaching the full force of the Canadian market. Removing barriers to trade between provinces and territories will help build a more prosperous economy—creating jobs, fueling business expansion. Expanding consumer choice of Canadian goods and services. And helping regional economies grow.

-

Budget 2021 proposes to allocate $21 million over three years, starting in 2021-22, to:

- Work with provincial and territorial partners to enhance the capacity of the Internal Trade Secretariat. That supports the Canadian Free Trade Agreement in order to accelerate the reduction of trade barriers within Canada.

- Advance work with willing partners towards creating a repository of open and accessible pan-Canadian internal trade data to identify barriers. Including licensing and professional certification requirements, that we can work together to reduce.

- Pursue internal trade objectives through new or renewed discretionary federal transfers to provinces and territories.

Supporting Jobs and Growth in All Communities

As Canada builds back better, no community will be left behind. From the outset of the pandemic, regional development agencies have been on the ground across Canada. Helping businesses weather the effects of the pandemic. Through the $2 billion Regional Relief and. Recovery Fund, they have been providing liquidity to businesses, helping bridge them to recovery. And preserving more than 125,000 jobs. To ensure businesses in every corner of Canada have the support they need to get through the pandemic. And that they are brought along in our economic recovery:

-

Budget 2021 proposes to provide $700 million over three years, starting in 2021-22. For the regional development agencies to support business financing. This would position local economies for long-term growth by transitioning to a green economy, fostering an inclusive recovery. Enhancing competitiveness, and creating jobs in every corner of the country.

-

Budget 2021 proposes to create a new agency for British Columbia and to provide $553.1 million over five years. Starting in 2021 22, and $110.6 million ongoings. To support the new agency and ensure businesses in B.C. can grow and create good jobs for British Columbians. Existing core program funding from Western Economic Diversification. Will remain to support the Prairies, making additional support available for businesses in Alberta, Saskatchewan, and Manitoba.

-

Furthermore, the federal government will work to make FedNor a standalone regional development agency. And strengthen the economic development of Northern Ontario.

Canada Community Revitalization Fund

Main streets, farmers’ markets, and other gathering places underpin local economies. In many communities, the most vibrant spaces in our communities have laid dormant as Canadians took precautions to stay safe. Recognizing that economic recovery is tightly linked to the vitality of our local communities:

-

Budget 2021 proposes to provide $500 million over two years. Starting in 2021-22, to the regional development agencies for community infrastructure. These projects will stimulate local economies, create jobs. And improve the quality of life for Canadians from coast to coast to coast.

Recommended Posts

Weekend Reading: Embracing Simplicity Edition

July 12, 2021

Weekend Reading: Unhealthy Housing Market Edition

June 18, 2021

Weekend Reading: A Money Grab Edition

June 8, 2021

[…] spring, then CMHC boss Evan Siddall predicted that home prices would fall between 9-18% due to the economic impact of the pandemic. So, what […]